Quantopian Day Trading Algorithm

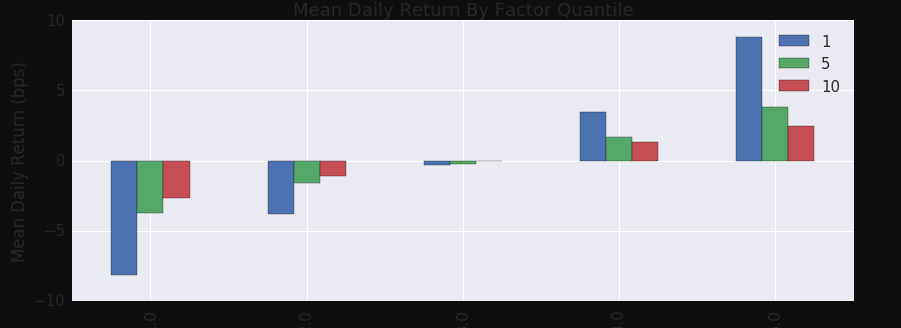

Forex Algorithmic Trading Tutorial F Quantopian Getting Started in Algorithmic Trading. I found Pipeline is providing a tremendous value when it comes to trading wide range of universe.

Forex Algorithmic Trading Strategies My Experience Toptal

Forex Algorithmic Trading Strategies My Experience Toptal

Quantopian community members help each other every day on topics of quantitative finance algorithmic trading new quantitative trading strategies the Quantopian trading contest and much more.

/dotdash_Fina_Pick_the_Right_Algorithmic_Trading_Software_Feb_2020-01-e58558a7c8f14325ab0edc2a7005ab68.jpg)

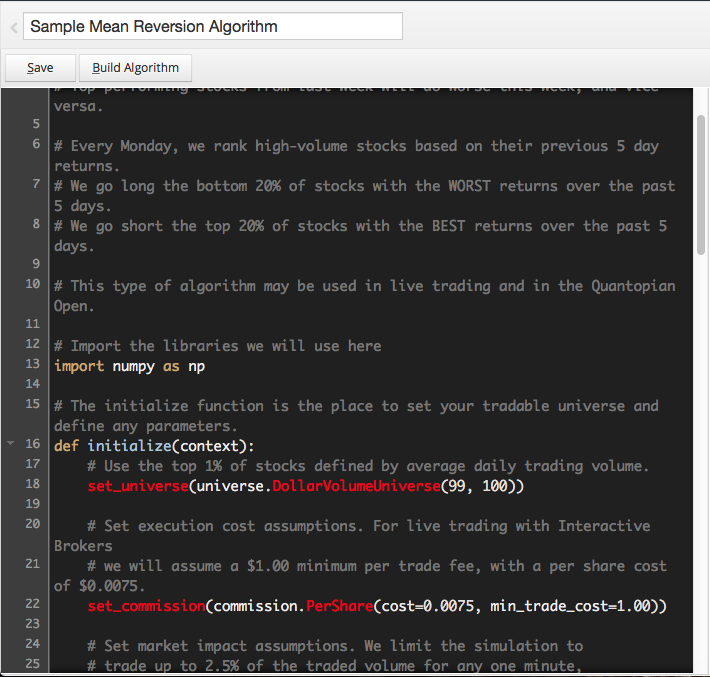

Quantopian day trading algorithm. Modelling a Financial System with a Variable Degree of Automation Display Design and Evaluation Yeti Li Nov 2017. You might want to improve your strategy. Pipeline API is the core piece of Quantopian algorithm framework that allows easy stock selection based on the different metrics much in a pythonic way and this differentiates the platform from others.

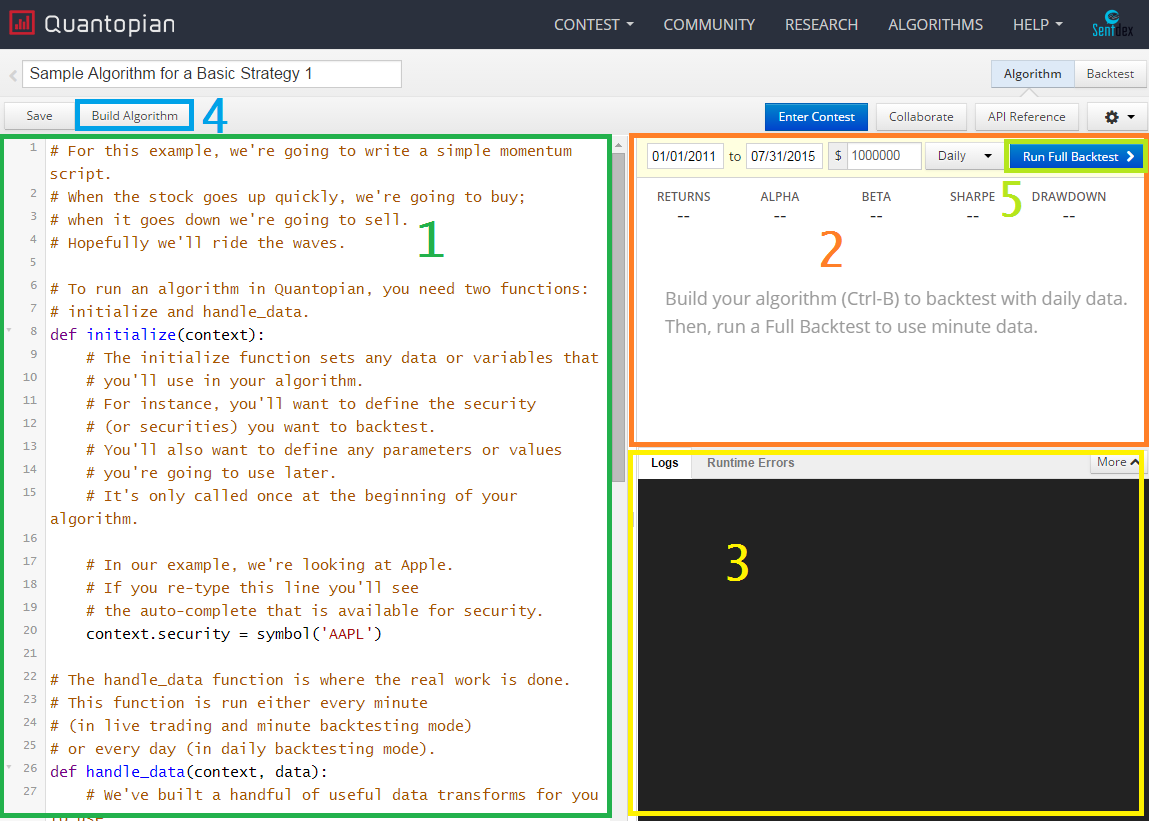

You can backtest ideas with a huge collection of data sets from the Quantopian algorithm library tutorials and lectures. Build a Day-Trading Algorithm and Run it in the Cloud Using Only Free Services. Handle_data runs once per.

5 For how long is Zerodha Streak Platform Free. Quantopian provides secrecy and. The Zerodha Streak Platform is presently totally free to use for Zerodha Trading Account owners throughout the testing stage.

Research Exploring Automated Trading. Momentum Trading Quantopian Developing Your Trading Strategy on Quantopian. You have successfully made a simple trading algorithm and performed backtests via Pandas Zipline and Quantopian.

This course will guide you through everything you need to know to use Python for Finance and Algorithmic Trading. The algorithm is trained with historical stock price data by looking at the price movement of a stock in the last 10 days and learning if the stock price increased or decreased on the 11th day. Well start off by learning the fundamentals of Python and then proceed to learn about the various core libraries used in the Py-Finance Ecosystem including jupyter numpy pandas matplotlib statsmodels zipline Quantopian and.

Algorithm-based stock trading is shrouded in mystery at financial firms. Day trading is an exhausting activity for a human in terms of. When I first started learning about how easy its become to take control of my money in the market day trading jumped out at me as the thing to do.

A new startup Quantopian aims to make these algorithms available to a much larger audience. Then the algorithm can predict whether or not a stock price will increase based on how the price has improved in the last 10 days. Zipline is capable of back-testing trading algorithms including accounting for things like slippage as well as calculating various risk metrics.

A trader may like to. Commission-free stock trading on a free Google Cloud Platform instance step-by-step. Quantopian is built on top of a powerful back-testing algorithm for Python called Zipline.

Quantopian provides this presentation to help people write trading algorithms it is not intended to provide investment advice. The initialize method runs once upon the starting of the algorithm or once a day if you are running the algorithm live in real time. Algorithmic trading is a process for executing orders utilizing automated and pre-programmed trading instructions to account for variables such as price timing and volume.

Is Zerodha streak totally free. An algorithm is a set. The use of.

The system is totally free till 31st March 2018. Of course if it were really as easy as it sounds everyone would be doing it. Best Day Trading Courses Best Forex Trading Courses.

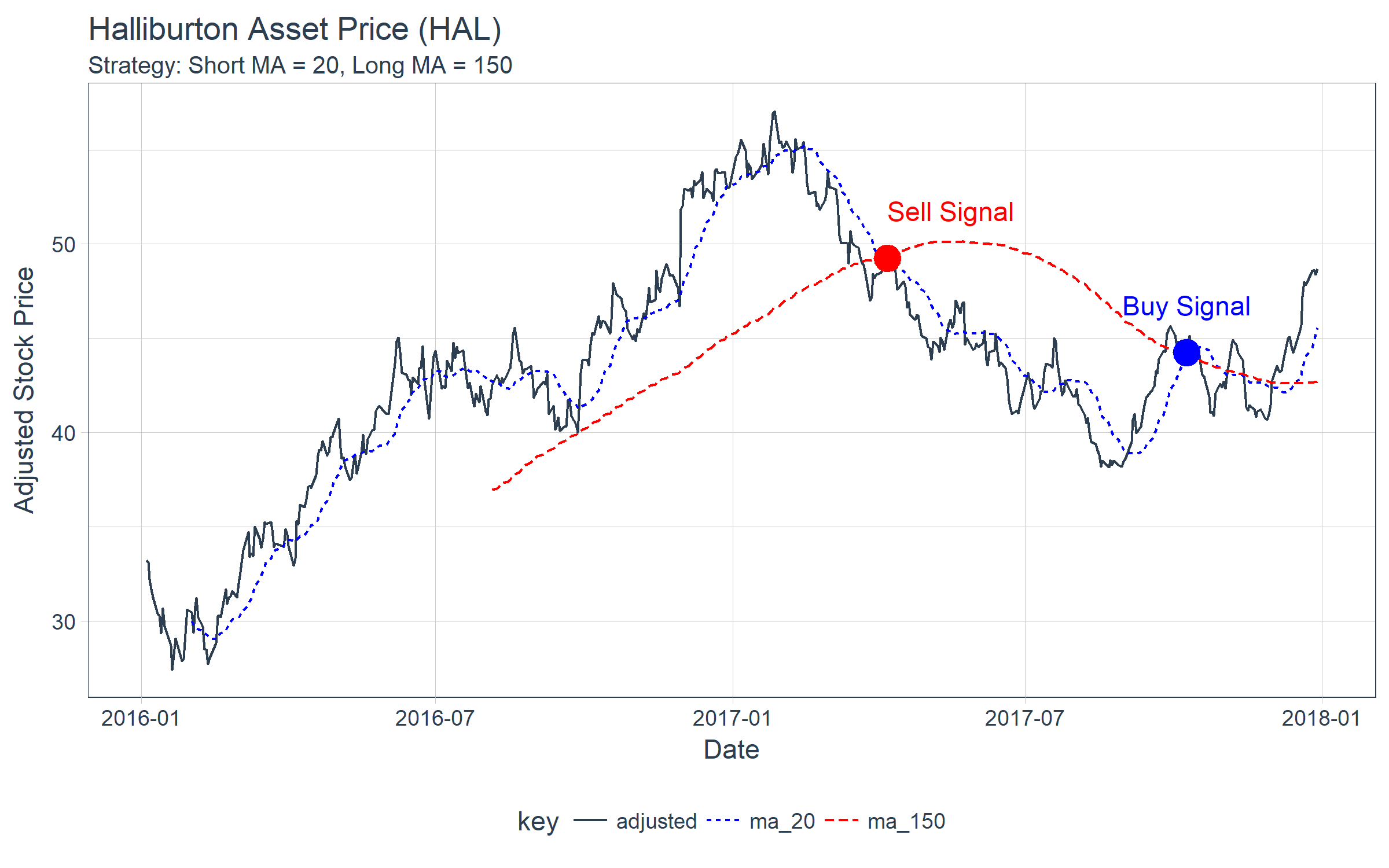

They should be included in every algorithm you start new. Investors are owning their own created trading algorithms. Most algorithmic trading software offers standard built-in trade algorithms such as those based on a crossover of the 50-day moving average MA with the 200-day MA.

Its fair to say that youve been introduced to trading with Python. At the end of the trading day we liquidate any remaining positions weve opened at market price. However when you have coded up the trading strategy and backtested it your work doesnt stop yet.

Every time you create an algorithm with Zipline or Quantopian you will need to have the initialize and handle_data methods. Or within day-trading amount of time of mins or hrs.

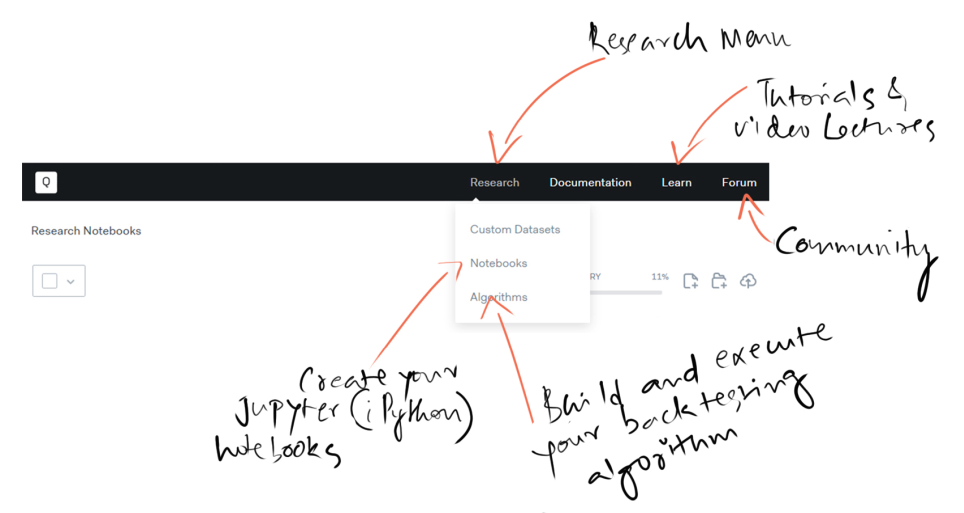

Quantitative Trading Part 2 Getting Started With Quantopian The Platform By Pythoslabs Medium

Quantitative Trading Part 2 Getting Started With Quantopian The Platform By Pythoslabs Medium

Quantopian Vs Alpaca When Paper Trading Your Algorithms By Matthew Tweed Automation Generation Medium

Quantopian Vs Alpaca When Paper Trading Your Algorithms By Matthew Tweed Automation Generation Medium

/dotdash_Fina_Pick_the_Right_Algorithmic_Trading_Software_Feb_2020-01-e58558a7c8f14325ab0edc2a7005ab68.jpg) Pick The Right Algorithmic Trading Software

Pick The Right Algorithmic Trading Software

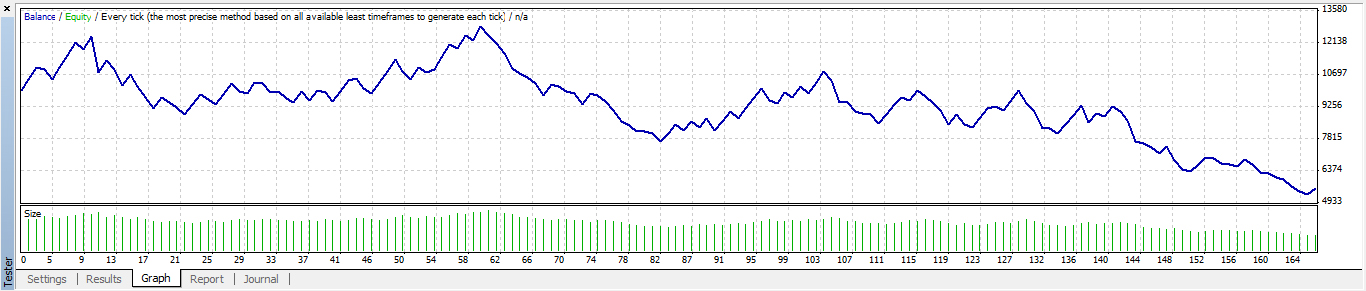

Quantopian Backtesting Speed Day Trading Strategy Stocks

How My Machine Learning Trading Algorithm Outperformed The Sp500 For 10 Years By Tomiwa Towards Data Science

How My Machine Learning Trading Algorithm Outperformed The Sp500 For 10 Years By Tomiwa Towards Data Science

Quantopian Quantpedia Trading Strategy Series Reversals In The Pead Quantpedia

Introduction To Pairs Trading Youtube

Introduction To Pairs Trading Youtube

Algorithmic Trading Using Quantopian S Zipline Python Library In R And Backtest Optimizations By Grid Search And Parallel Processing

Algorithmic Trading Using Quantopian S Zipline Python Library In R And Backtest Optimizations By Grid Search And Parallel Processing

Introduction To Algorithmic Trading With Quantopian

Introduction To Algorithmic Trading With Quantopian

Quantopian Has 100m In Algorithmic Investing Trading Volume In May Opens Platform To All Investors

How To Learn Algorithmic Trading Fast And Easy Trade Options With Me

How To Learn Algorithmic Trading Fast And Easy Trade Options With Me

Macd Strategy Quantopian Results Of The Backtest

Macd Strategy Quantopian Results Of The Backtest

9 Great Tools For Algo Trading In The Last 5 10 Years Algorithmic By Alpaca Hackernoon Com Medium

9 Great Tools For Algo Trading In The Last 5 10 Years Algorithmic By Alpaca Hackernoon Com Medium

Backtesting Futures In Quantopian Youtube

Backtesting Futures In Quantopian Youtube

Quantopian Idea To Algorithm The Full Workflow Behind Developing A Quantitative Trading Strategy Youtube

Quantopian Idea To Algorithm The Full Workflow Behind Developing A Quantitative Trading Strategy Youtube

Quantopian Technology To Backtest And Execute Algorithmic Trading Byte Revel

Quantopian Technology To Backtest And Execute Algorithmic Trading Byte Revel

How To Build A Simple Bitcoin Trading Algorithm With Kory Hoang Part 1 2 By Stably Stably Medium

How To Build A Simple Bitcoin Trading Algorithm With Kory Hoang Part 1 2 By Stably Stably Medium

4 Crowdsourced Hedge Funds For Algorithmic Trading Nanalyze

4 Crowdsourced Hedge Funds For Algorithmic Trading Nanalyze

Post a Comment for "Quantopian Day Trading Algorithm"