Does Canada Have Day Trading Rules

PDT rule does not apply to cash accounts. Not only is this great news for day traders it just might save you quite a bit of heartache come tax time.

Pattern Day Trader Rule Definition And Explanation

Pattern Day Trader Rule Definition And Explanation

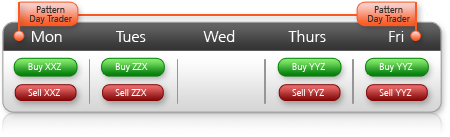

On margin account with under 25000 balance you are allowed 3 day trades within 5 trading days period.

Does canada have day trading rules. Taxes Canada treats profits made from day trading as business income not capital gains. Day trading is regulated by the Canadian government which sets trade rules and establishes a process for documenting income and losses for tax purposes. Having day trades that exceed 6 of the accounts trading activity.

On margin account with over 25000 balance you are allowed unlimited number of day trades. They allow you to trade with no restrictions. This is because the CRA sees day trading as business income.

It is thus best to avoid day trading in your TFSA entirely. Day trading tax rules in Canada are on the whole relatively fair. Traders are subject to the three day clearing rule which means after a trader with a cash account sells a security they must wait three business days to access the funds to trade again.

Trading rules If youd like to do day trading or trade frequently dont do it in your TFSA. Once you have identified which of the brackets detailed below your trading activity falls into you are required to pay taxes on your generated income by the end of the tax year December 31st. However traders under the three day clearing rule are still able to use any settled funds to buy securities.

No Wash Sale Rule for Day Trading Taxes. For more details on the pattern rule and also 30 day trading superficial loss and regulatory rules from the CRA read our Canada specific Rules pages. In fact the Bullish Bears Facebook group is filled with traders under that restriction.

Therefore TD Ameritrade allows unlimited number of day trades on cash accounts. Losses will be disallowed if both of the following two conditions are met from section 54 of the Income Tax Act. Its important to have a diversified portfolio and this can mean having foreign dividend-paying stocks particularly in a sector that might not be well represented on the Canadian Stock Exchange.

As per tax rules you need to pay tax on any business income. Youre also limited to three day trades within a rolling five day trading period. Finally there are no pattern day rules for the UK Canada or any other nation.

Youre Forced to Close Using Year-End Prices. On top of the rules around pattern trading there exists another important rule to be aware of in the US. If you day trade in Canada there is no prescribed minimum but your broker may require you to adhere to the 25K rule if you are buying securities that settle in the US.

The required minimum equity must be in the account prior to any day-trading activities. The government might consider your trading activity as a business and you will have to pay income tax. If a trader is classified as a pattern day trader according to the SEC definitionor by a brokers discretionand the trader does not have the required 25000 equity balance in their account they will be prevented from making further day trades.

A pattern day trader will have access to the higher of the two amounts. Under the rules a pattern day trader must maintain minimum equity of 25000 on any day that the customer day trades. These rules are set by the US FNRA and therefore apply only in the US.

You can trade with this money. You may be surprised to learn that your trading activity could constitute a business even if its done inside a TFSA. They can however get more complicated if you want to trade US securities from Canada.

However late and non-payments can result in serious consequences. According to TD Ameritrades day trading rules a pattern day trader has two buying power calculations. A day trade is considered buying and selling the same stock on the same trading day.

Just make sure your account equity stays above that level. If you want to day trade futures contracts most brokers require a minimum account balance of 1000 but 8000-10000 is recommended by many providers. If you violate either of the above rules you will need to deposit 25000 in your account.

TFSA Stock Trading Rules. If you do so the CRA may fine you. As a result day trading can limited.

When you have MTM trading status the wash sale rule does not apply to you. Cash Support Day Trading Limits. When you buy stock using Cash App Investing you are limited to the buying power of your Cash App balance and your Add Cash limits.

If it is being deposited into your TFSA however you are evading paying taxes on it. The PDT rule is one that most traders have to adhere to if they want to trade with margin and are below 25k in their brokerage account. Pattern day trading rules in Canada are not the same as in the US they are a little more relaxed.

As the name suggests the 30-day trading rule in Canada applies to the period beginning 30 days before the day of the sale transaction for the capital loss in question and the 30 days afterwards.

How To Find The Best Day Trading Stocks Young And Thrifty

How To Find The Best Day Trading Stocks Young And Thrifty

Margin Interactive Brokers Canada Inc

Margin Interactive Brokers Canada Inc

Question Of The Week Can You Day Trade Through Your Tfsa Nova Scotia Securities Commission

Question Of The Week Can You Day Trade Through Your Tfsa Nova Scotia Securities Commission

Top 10 Big Mistakes Forex Day Traders Forex Day Trader Forex Signals

Top 10 Big Mistakes Forex Day Traders Forex Day Trader Forex Signals

:strip_icc()/day-trading-tips-for-beginners-on-getting-started-4047240_FINAL-e9aa119145324592addceb3298e8007c.png) Day Trading Tips For Beginners

Day Trading Tips For Beginners

Don T Succumb To The Vicious Temptation Of Overtrading It Kills Your Account Forex Makemoney Trading Wetal Trading Quotes Trading Strategies Day Trading

Don T Succumb To The Vicious Temptation Of Overtrading It Kills Your Account Forex Makemoney Trading Wetal Trading Quotes Trading Strategies Day Trading

How To Get Around The Pdt Rule Day Trading Small Account Pattern Day Trader Rule Explained Youtube

How To Get Around The Pdt Rule Day Trading Small Account Pattern Day Trader Rule Explained Youtube

Day Trading Taxes In Canada Tfsa Investing For Beginners Youtube

Day Trading Taxes In Canada Tfsa Investing For Beginners Youtube

Td Ameritrade Pattern Day Trading Rules Pdt For 2021

Td Ameritrade Pattern Day Trading Rules Pdt For 2021

Do You Strive To Make A Massive Shift In Your Account Balance Check Out Our Free Telegram Channel For Dail In 2020 Forex Trading Quotes Trading Quotes Trading Charts

Do You Strive To Make A Massive Shift In Your Account Balance Check Out Our Free Telegram Channel For Dail In 2020 Forex Trading Quotes Trading Quotes Trading Charts

Don T Get Caught Out By The Pattern Day Trader Pdt Rule By Leah Mathieson Medium

Pattern Day Trader Rule Definition And Explanation

Pattern Day Trader Rule Definition And Explanation

Forextradinginfoandeducation Trade Finance Stock Options Trading Investing

Forextradinginfoandeducation Trade Finance Stock Options Trading Investing

Top 28 Most Famous Day Traders And Their Secrets Trading Education

Top 28 Most Famous Day Traders And Their Secrets Trading Education

Pattern Day Trading Rule Understanding Pdt Restrictions And Brokers With No Pdt Rule

Pattern Day Trading Rule Understanding Pdt Restrictions And Brokers With No Pdt Rule

Calculating Taxes When Day Trading In Canada Fbc

Calculating Taxes When Day Trading In Canada Fbc

Is Pattern Day Trading Illegal The Lie Of Pdt Being Bad

Is Pattern Day Trading Illegal The Lie Of Pdt Being Bad

Post a Comment for "Does Canada Have Day Trading Rules"