Day Trading Taxes Nz

Instead 100 of all profits are taxed at your current tax rate. You must attach a statement with your tax return stating that you are making the election under section 475f of the Internal Revenue Code.

Forget The Elliot Wave Fibonacci Theories Horoscopes And Crystal Balls Prediction Is For Mystics And Losers To H Trading Charts Trade Finance Forex Trading

Forget The Elliot Wave Fibonacci Theories Horoscopes And Crystal Balls Prediction Is For Mystics And Losers To H Trading Charts Trade Finance Forex Trading

For tax purposes the mark-to-market election values your securities as if you had sold them on the last trading day of the year.

Day trading taxes nz. We talk about DayTrading taxes and how they work. For example your salary income is Rs. With day trading your gains and losses still go on Schedule D but your business expenses such as margin interest computer costs allocatable to the business etc.

Trader-status sets profit at the income tax rate which does not get the long-term capital-gain rate but allows any amount of trading loss to be deducted. At the same time 100 of any losses are deductible too. There are two capital gains rates in the US that can affect taxes on day trading.

Do Day Traders Pay Quarterly Taxes. For accounting purposes as well as a variety of practical reasons traders should maintain separate accounts for day trading and. If your profits are larger than your losses and thats the goal you may need to pay quarterly.

If youre day trading you hold an asset only for a limited time so you will fall under the trading taxes umbrella. Continue Reading Below People who are not used to these types of. Heres what you need to do know about day trading including free trading charts trading strategies and day-trading software and platforms.

If youve had a poor trading year this could save you considerable sums. With day trading taxes we may have to pay taxes quarterly. They purchase a property with the intention to sell it this rule was introduced in 2016.

This will then be taxed at your usual total income slab. Day trading tax rules in Canada are on the whole relatively fair. If a stock is held for less than 12 months and makes a profit when sold it is taxed at.

Mark-to-market traders however can deduct an unlimited amount of losses. While no general capital gains tax applies in New Zealand tax on gains made may apply to NZ investors trading shares when. So the larger loss deduction can flow-through to the overall personal tax liability.

Usually investors can deduct just 3000 or 1500 in net capital losses each year. If you fall under this bracket any day trading profits are free from income tax business tax and capital gains tax. As a result you cant use the 50 capital gains rate on any profits.

As more individuals dabble in day-trading during the coronavirus pandemic some may be surprised by the tax implications next year. The long-term capital gains rate and the short-term capital gains rate. Updated November 30 2020.

For example if you had 40000 worth of successful short-term trades and 10000 worth of losses your net profit would be 30000. The first category is speculative in nature and similar to gambling activities. For day traders any profits and losses are treated as business income not capital.

Taxes for day trading income are paid after expenses which includes any losses at your personal tax rate. Day traders play the markets to try and take advantage of short-terms fluctuations in value of stock futures and other financial products. When we think of tax season we think of April right.

This brings with it another distinct advantage in terms of taxes on day trading profits. Go on Schedule C. That can be applied to other sources of income as well.

As you can probably imagine falling into this category isnt a walk in the park more on that later. Have you thought about becoming a Maker to Market cl. That would mean paying a tax payment every 4 months.

Its always best to check with your accountant on that. Or a day trader that makes hundreds of trades per day can choose trader-status with the IRS. 5 lacs and your daily trade profits are 24 lacs then your total income would be 74 lacs which would be taxed as per 20 slab.

The main rule to be aware of is that any gain you make from trading is considered as normal taxable income. The flip side is that traders cannot use this income as the basis for making business retirement plan contributions. Once you have identified which of the brackets detailed below your trading activity falls into you are required to pay taxes on your generated income by the end of the tax year December 31st.

A day trader hopes that these trades will result in a net profit over the course of a year which of course means theyll need to pay taxes on them. The Internal Revenue Service requires you to subtract short-term losses from short-term gains to calculate your day-trading profit. In effect your losses will be on Schedule D limited to 3000 like everyone else but your day trading expenses will go on Schedule C unlike others classified as.

Unlike other Schedule C taxpayers the profits from trading are not subject to the self-employment tax a tax consisting of Social Security tax and Medicare tax for those who work for themselves which is a positive. Separating long-term and short-term trading accounts may make it easier to calculate day trading taxes. Have you ever heard of a Wash Sale.

Speculative business income All profits will be added or netted to your other incomes. Day trading on the stock market involves capitalizing on the rise and fall of stock prices.

How To Make 80 000 In Crypto Profits And Pay Zero Tax

How To Make 80 000 In Crypto Profits And Pay Zero Tax

Pin By Khareem Brucedayne Sudlow On Online Business Marketing Online Business Marketing Employment Application Internet Business

Pin By Khareem Brucedayne Sudlow On Online Business Marketing Online Business Marketing Employment Application Internet Business

How To Fill Out A W 4 Form H R Block Finances Money Finance Personal Finance

How To Fill Out A W 4 Form H R Block Finances Money Finance Personal Finance

How To Pay Taxes On Payouts Made From Online Forex Trading

Psychology Of What Could Happen The Next 4 Year With The Market Stock Market Data Stock Market Marketing Data

Psychology Of What Could Happen The Next 4 Year With The Market Stock Market Data Stock Market Marketing Data

Income Tax Refund Company Nz Inland Revenue Tax Refund Status Penny Geni U Tax Refund Income Tax Income

Income Tax Refund Company Nz Inland Revenue Tax Refund Status Penny Geni U Tax Refund Income Tax Income

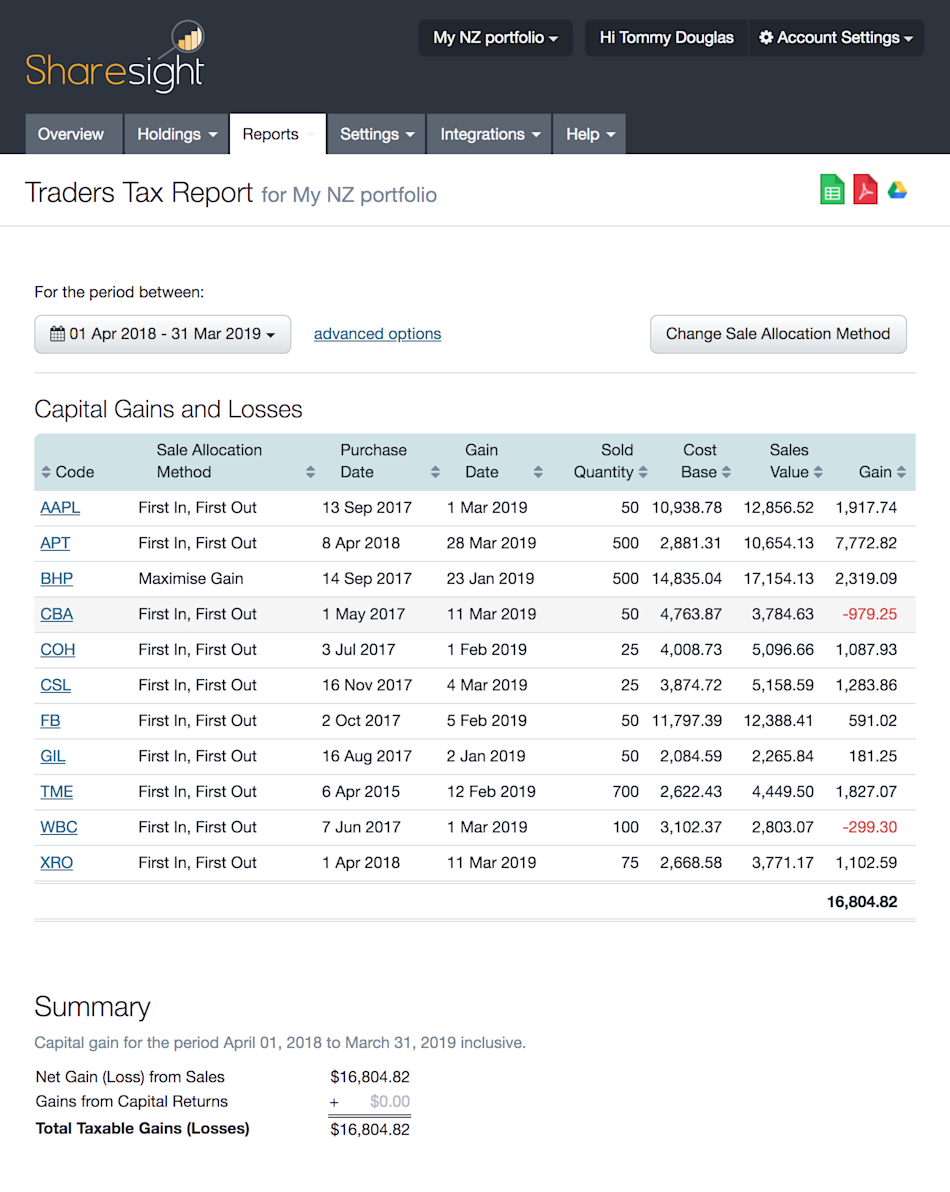

Calculating Taxable Gains On Share Trading In New Zealand Sharesight

Calculating Taxable Gains On Share Trading In New Zealand Sharesight

The New Stock Market Ebook Economics Marketing

The New Stock Market Ebook Economics Marketing

Terms Used In Budget What Is Direct Tax Intraday Trading Stock Options Trading Budgeting

Terms Used In Budget What Is Direct Tax Intraday Trading Stock Options Trading Budgeting

Crypto Tax Irs Catching Investors Who Don T Pay Taxes Daytrading

Crypto Tax Irs Catching Investors Who Don T Pay Taxes Daytrading

Forex Trading Forextrading Consumer Price Index Employment Report Stock Market

Forex Trading Forextrading Consumer Price Index Employment Report Stock Market

Here Are Some Good Web Sites For Canadian Day Traders Offering Day Trading Strategies Along With Techniques And Ideas Day Trader Day Trading Social Marketing

Here Are Some Good Web Sites For Canadian Day Traders Offering Day Trading Strategies Along With Techniques And Ideas Day Trader Day Trading Social Marketing

Terms Used In Budget What Is An Indirect Tax Intraday Trading Stock Options Trading Indirect Tax

Terms Used In Budget What Is An Indirect Tax Intraday Trading Stock Options Trading Indirect Tax

Cryptocurrency Exchange Cryoptia Suffered A Security Breach And Incurred Significant Losses Withdrawals Prior To Bre Cryptocurrency Investigations Exchange

Cryptocurrency Exchange Cryoptia Suffered A Security Breach And Incurred Significant Losses Withdrawals Prior To Bre Cryptocurrency Investigations Exchange

Terms Used In Budget What Is Gst Intraday Trading Goods And Services Stock Options Trading

Terms Used In Budget What Is Gst Intraday Trading Goods And Services Stock Options Trading

Secret Tax Hacks Investment Quotes Real Estate Investor Investing

Secret Tax Hacks Investment Quotes Real Estate Investor Investing

Epic Research Offers Financial Advisory Services Like Mcx Trading Tips To Traders And Investors Our Team Consists Of Financial Advisory Marketing Stock Market

Epic Research Offers Financial Advisory Services Like Mcx Trading Tips To Traders And Investors Our Team Consists Of Financial Advisory Marketing Stock Market

Who Is Eligible For Rajiv Gandhi Equity Savings Scheme Income Tax Concessions Equity Investing Rajiv Gandhi

Who Is Eligible For Rajiv Gandhi Equity Savings Scheme Income Tax Concessions Equity Investing Rajiv Gandhi

Post a Comment for "Day Trading Taxes Nz"