Day Trading Taxes Canada Reddit

Day trading tax laws and recent cases tell us youre a trader if you meet the requirements tested in Endicott vs Commissioner TC Memo 2013-199. I need to know how exactly to enter my investment income into TurboTax so that it.

Forex Trading Ultimatelearnforex Online Trading Forex Trading Forex

Forex Trading Ultimatelearnforex Online Trading Forex Trading Forex

Frequency of transactions a history of extensive buying and selling of securities or of a quick turnover of properties.

Day trading taxes canada reddit. As per tax rules you need to pay tax on any business income. However late and non-payments can result in serious consequences. That can be applied to other sources of income as well.

Canada loses 213000 jobs in January unemployment rate jumps to 94. On the whole profits from intraday trade activity are not considered capital gains but business income. Good volume in the premarket with premarket resistance around 1028-1029.

Once you have identified which of the brackets detailed below your trading activity falls into you are required to pay taxes on your generated income by the end of the tax year December 31st. Therefore profits reported as gains are subject to taxation while losses are deductible. Day trading 101 get to grips with trading stocks or forex live using a demo account first they will give you invaluable trading tips.

As a result you cant use the 50 capital gains rate on any profits. How likely is it that my method of reporting will be challenged. Help Reddit App Reddit coins Reddit premium Reddit gifts.

Instead 100 of all profits are taxed at your current tax rate. The long-term capital gains rate and the short-term capital gains rate. But now that I am a day trader who has suffered significant losses day trading TurboTax seems to be failing me.

How do day trading taxes work. Help Reddit App Reddit coins Reddit premium Reddit gifts. With day trading taxes we may have to pay taxes quarterly.

That would mean paying a tax payment every 4 months. The individual aimed to catch and profit from the price fluctuations in the daily market movements. Posted by 1 day ago.

Hope you enjoyed your three-day weekend and we are back at it again today Large Cap Watchlist over 10. For accounting purposes as well as a variety of practical reasons traders should maintain separate accounts for day trading. This is because the CRA sees day trading as business income.

Gapping up on momentum from the last couple days of trading. First you must look to profit from daily price movements in the security. If you do it in a TFSA CRA looks a the big picture using these 8 factors.

Usually I just answer its questions and TurboTax leads me to the right answers but not apparently when it comes to day trading. If a stock is held for less than 12 months and makes a profit when sold it is taxed at. There are two capital gains rates in the US that can affect taxes on day trading.

If your profits are larger than your losses and thats the goal you may need to pay quarterly. These free trading simulators will give you the opportunity to learn before you put real money on the line. This will then be taxed at your usual total income slab.

Day Trading Tax Rules Day trading income tax rules in Canada are relatively straightforward. You can day trade if you want. Second when the IRS looks at your tax return all or most of your income must come from day trading to meet the substantial activity rule.

Its always best to check with your accountant on that. Unlike other Schedule C taxpayers the profits from trading are not subject to the self-employment tax a tax consisting of Social Security tax and Medicare tax for those who work for themselves which is a positive. Knowledge of securities markets the taxpayer has some knowledge of or.

Third you must day trade on a regular and continual basis. I will be reporting it as business income as I have around 1800 or more full trades in 2020. Day trading tax rules in Canada are on the whole relatively fair.

Separating long-term and short-term trading accounts may make it easier to calculate day trading taxes. For day traders any profits and losses are treated as business income not capital. I have used TurboTax for at least 10-20 years and it has been great.

The two considerations were as follows. Collectively however they would reveal a pattern of activity thats consistent with either an investment or trading intention. Period of ownership securities are usually owned only for a short period of time.

Hello guys this is my first year doing day trading taxes and I recently found out about acb. If this happens you are restricted from day trading for 90 days or until you reach 25k in account equity - see next sentence and you now must hold all. At the same time 100 of any losses are deductible too.

3 Following up to the point above with Instant you cannot day trade 4 times in a 5 day period because it is a margin account. An informal survey of Tax Court of Canada looked at cases after the year 2000 and discovered 10 cases that had security transactions in dispute. The IRS looks at three things to determine if you are a day trader.

The individuals trading was substantial. The flip side is that traders cannot use this income as the basis for making business retirement plan contributions. This will get you flagged as a PDT pattern day trader.

It is thus best to avoid day trading in your TFSA entirely. 5 lacs and your daily trade profits are 24 lacs then your total income would be 74 lacs which would be taxed as per 20 slab. If you do so the CRA may fine you.

Speculative business income All profits will be added or netted to your other incomes. How do day trading taxes work. I havent been keeping track of my acb and Im getting really stressed out reading about it.

If it is being deposited into your TFSA however you are evading paying taxes on it. For example your salary income is Rs.

Build A Roth Ira Conversion Ladder To Minimize Taxes In Early Retirement Roth Ira Conversion Roth Ira Early Retirement

Build A Roth Ira Conversion Ladder To Minimize Taxes In Early Retirement Roth Ira Conversion Roth Ira Early Retirement

If You Ve Ever Wondered About The Wealth Of European Countries Compared To The Us This Map Is For You Reddit User Speech50 Geography Map Map World Geography

If You Ve Ever Wondered About The Wealth Of European Countries Compared To The Us This Map Is For You Reddit User Speech50 Geography Map Map World Geography

Capital Gains Tax Rate Rules In Canada 2020 What You Need To Know

Capital Gains Tax Rate Rules In Canada 2020 What You Need To Know

State By State Guide To Taxes On Retirees With Images Retirement Income Tax Retirement Benefits

State By State Guide To Taxes On Retirees With Images Retirement Income Tax Retirement Benefits

Map Of Income Taxes And Social Security Contributions By Country In Europe European Map Map Country Maps

Map Of Income Taxes And Social Security Contributions By Country In Europe European Map Map Country Maps

What Are The Tax Write Offs For A Small Business In Canada Madan Ca

What Are The Tax Write Offs For A Small Business In Canada Madan Ca

Home Based Business Ideas Reddit And Home Business Ideas In Kuwait An Home Based Business Tax De Warren Buffet Quotes Investment Quotes Personal Finance Quotes

Home Based Business Ideas Reddit And Home Business Ideas In Kuwait An Home Based Business Tax De Warren Buffet Quotes Investment Quotes Personal Finance Quotes

Things To Know About Tax Refunds In Canada Wealthsimple

Things To Know About Tax Refunds In Canada Wealthsimple

Calculating Taxes When Day Trading In Canada Fbc

Calculating Taxes When Day Trading In Canada Fbc

Stock Market How Taxes Work In Canada Youtube

Stock Market How Taxes Work In Canada Youtube

Bezos Billions The Wealth Of A Centi Billionaire It S Safe To Say That 2017 Was A Great Infographs Technology Jeffbezos In Bezos Jeff Bezos Investing

Bezos Billions The Wealth Of A Centi Billionaire It S Safe To Say That 2017 Was A Great Infographs Technology Jeffbezos In Bezos Jeff Bezos Investing

Bitcoin Price Coin Market Cap Buy Bitcoin Blockchain Cryptocurrency

Bitcoin Price Coin Market Cap Buy Bitcoin Blockchain Cryptocurrency

Day Trading Taxes In Canada 2020 Day Trading In Tfsa Account Youtube

Day Trading Taxes In Canada 2020 Day Trading In Tfsa Account Youtube

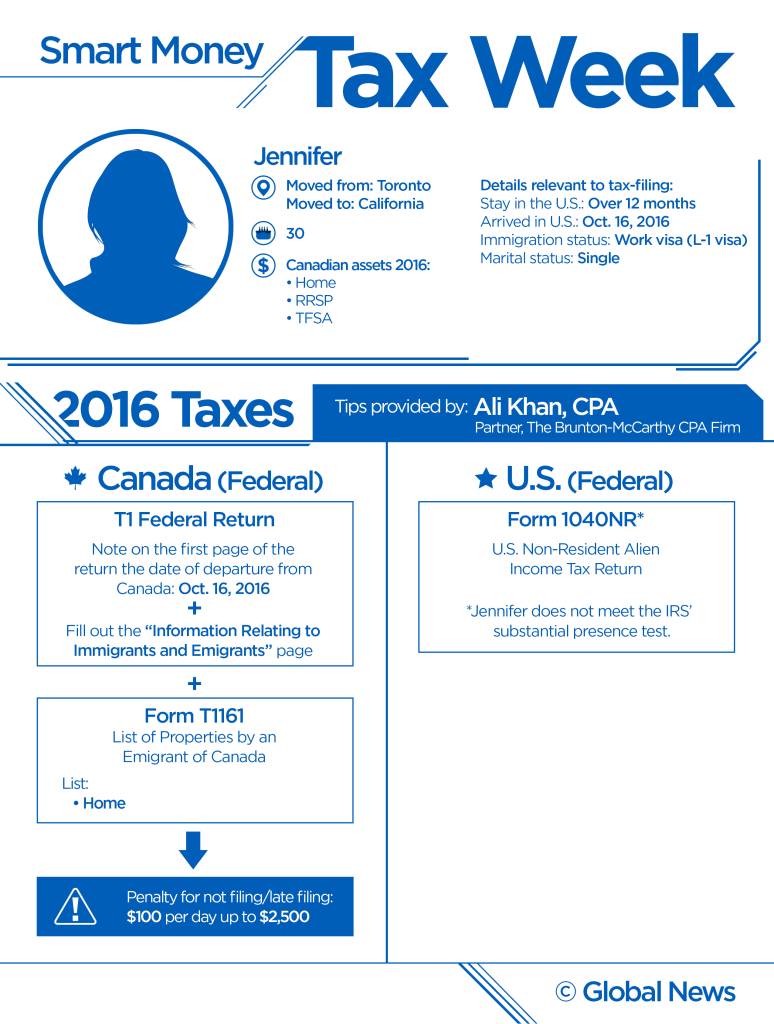

Moving Abroad Mistakes On Your Tax Return Could Wipe Out Your Savings Globalnews Ca

Moving Abroad Mistakes On Your Tax Return Could Wipe Out Your Savings Globalnews Ca

Day Trading Taxes In Canada Tfsa Investing For Beginners Youtube

Day Trading Taxes In Canada Tfsa Investing For Beginners Youtube

Bit Coin Mining Machines Bitcoinminingmachines Best Cryptocurrency Best Cryptocurrency Exchange Bitcoin Mining

Bit Coin Mining Machines Bitcoinminingmachines Best Cryptocurrency Best Cryptocurrency Exchange Bitcoin Mining

Taxation Of Stock Options For Employees In Canada Madan Ca

Anyone Know How Much Tax You Have To Pay For Profits Via Crypto Bitcoinca

Anyone Know How Much Tax You Have To Pay For Profits Via Crypto Bitcoinca

Bitcoin Trading Tax Canada Investing Investment Advisor Portfolio Management

Bitcoin Trading Tax Canada Investing Investment Advisor Portfolio Management

Post a Comment for "Day Trading Taxes Canada Reddit"