Is Day Trading Bad For Taxes

This means you must pay the portion of Social Security that an employer normally pays for employees as well as Medicare taxes that an employer normally pays. There are many nuances and misconceptions about Section 475 mark to market accounting that is why its essential to learn the rules.

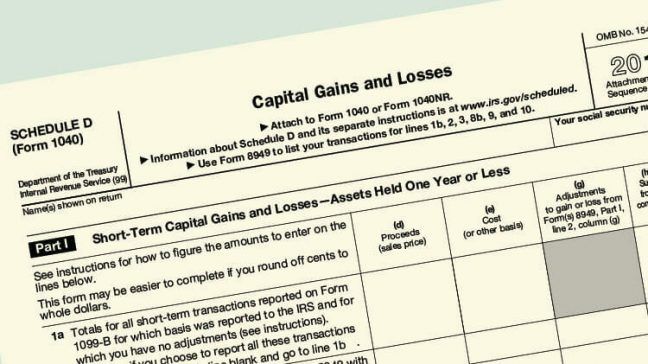

IRS tax laws exempt day traders from wash sale restrictions and capital loss limits.

Is day trading bad for taxes. Usually investors can deduct just 3000 or 1500 in net capital losses each year. Theres approximately 250 trading days. The IRS considers day-traders to be self-employed.

Long-term investments those held. Taxes in trading remain a complex minefield. Recent tax-court cases show that to help prevent IRS challenge of a TTS claim.

Long term trades means lower tax rates but if you are a day trader you most likely fall under the short term rate for most of your trades. Unfortunately such frequent trading has a number of downsides -- including the potential to be taxed at a higher rate than investors who dont trade as much. Hire yourself a good accountant so there are no surprises come tax time.

Unfortunately they are not avoidable and the consequences of failing to meet your tax responsibilities can be severe. Your trading status will also affect the amount of payable taxes on day trading. However anyone who gets to join the charmed circle of IRS-qualified traders gets to deduct 100 percent of expenses regardless of their adjusted gross income.

However this type of frequent trading also can trigger tax and accounting headaches that the average investor may find overwhelming. Day traders can make 05 percent to 3 percent on the high end per day on their capital. The researchers also found day trading to be a risky proposition.

In return the IRS expects day traders to keep scrupulous records of their trading activity and file accurate timely income tax returns. The case law says people who are traders for tax purposes need to make at least 720 trades in the year with an average holding period under 31 days. For most active traders the costs of necessitiessuch as.

Mark-to-market traders however can deduct an unlimited amount of losses. If your goal is to earn small profits from numerous daily trades you might want to have the IRS designate you as a day trader. Even when it works day trading is not a.

Greater deductibility of day trading expenses In general the IRS allows investors to deduct business expenses only if these expenses exceed 2 percent of adjusted gross income. Even the very best day trader earned 310 a day but with a standard deviation of 2560. A taxpayer may be a trader in some securities and may hold other securities for investment.

Because of these discrepancies there is a big difference in the potential returns of day traders versus investors. Its vital therefore you establish your tax status and understand your obligations. As more individuals dabble in day-trading during the coronavirus pandemic some may be surprised by the tax implications next year.

Thats probably because a home office deduction is limited to net profit from the business whether its from day trading or any other business. If your securities gains and schedule c are both a loss you would have no deduction for a home office. It doesnt matter whether you call yourself a trader or a day trader youre an investor.

Day trading the buying and selling of a security within a single trading day can be a profitable activity for experienced and skilled investors. Youre not exempt from day trading taxes. Because trading is not considered a business activity by the IRS all the expenses necessary to trade are not eligible as tax deductions.

For 2013 the self-employment tax rate is 153 percent on the first 113700 of income and 29 percent on income above 113700. It is wise to trade close to four days per week or 75 of available trading days even if this requires the taxpayer. Day Trading Taxes How to File For those entirely new to financial markets the basic distinction in tax structure is between long- and short term investments.

Day trading and paying taxes you cannot have one without the other. People who are not used to these types. If the nature of your trading activities doesnt qualify as a business youre considered an investor and not a trader.

If youve had a poor trading year this could save you considerable sums. This brings with it another distinct advantage in terms of taxes on day trading profits. That may not sound like much but it could equate to 10 percent to 60 percent per month.

Day Trading Salary See How Much Top Traders Make A Year

Day Trading Salary See How Much Top Traders Make A Year

Dabble In Day Trading Beware Of Tax Obligations Fox Business

Dabble In Day Trading Beware Of Tax Obligations Fox Business

Best Tax Software For Investors 2021 Investor Junkie

Best Tax Software For Investors 2021 Investor Junkie

How Traders Get Enormous Tax Deductions And Investors Do Not

How Traders Get Enormous Tax Deductions And Investors Do Not

How Frequent Traders Can Stay Organized For Taxes

How Frequent Traders Can Stay Organized For Taxes

Taxes On Trading Income In The Us Tax Rate Info For Forex Or Day Trading

Taxes On Trading Income In The Us Tax Rate Info For Forex Or Day Trading

Day Trading Taxes 2020 How To Maximize Your Profits Warrior Trading

Day Trading Taxes 2020 How To Maximize Your Profits Warrior Trading

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/dow-climbs-after-senate-passes-their-version-of-tax-reform-bill-885636594-5aa2281e8023b9003700b479.jpg) Why You Need A Daily Stop Loss

Why You Need A Daily Stop Loss

How Much Do Day Traders Make 94 119 In 3mo Trading Penny Stocks

How Much Do Day Traders Make 94 119 In 3mo Trading Penny Stocks

What Is Day Trading And How Does It Work Daveramsey Com

What Is Day Trading And How Does It Work Daveramsey Com

Account For Losses In Tax Returns To Lower Tax Liability

Account For Losses In Tax Returns To Lower Tax Liability

Is Pattern Day Trading Illegal The Lie Of Pdt Being Bad

Is Pattern Day Trading Illegal The Lie Of Pdt Being Bad

Day Trading Taxes Explained Youtube

Day Trading Taxes Explained Youtube

How To Avoid Taxes On Wash Sale Losses

How To Avoid Taxes On Wash Sale Losses

The 7 Factors That Hold People Back From Day Trading

The 7 Factors That Hold People Back From Day Trading

Day Traders Dumber Than Ever The Motley Fool

Day Traders Dumber Than Ever The Motley Fool

Automated Tax Loss Harvesting Is It Right For You Money Under 30

Automated Tax Loss Harvesting Is It Right For You Money Under 30

Post a Comment for "Is Day Trading Bad For Taxes"