How Does Day Trading Margin Work

When the two tools. Powerful tools real-time information and specialized service help you make the most of your margin trading.

Level 1 Definition Trading Terminology Day Trading Stock Options Trading Day Trader

Level 1 Definition Trading Terminology Day Trading Stock Options Trading Day Trader

How Does Day Trading Work.

How does day trading margin work. Day margin is the minimum requirement to day trade a contract which means opening and closing the position within the same trading session and not carrying a position past the sessions close. Margin is basically an act of extending credit for the purposes of trading. Buying on margin enhances a traders buying power by allowing them to buy for a greater amount than they have cash for.

Below are the main differences between a cash account and margin account when it comes to day trading. When combined with proper risk and money management trading on margin puts you in a better position to take advantage of market opportunities and investment strategies. In the most basic definition margin trading occurs when an investor borrows money to pay for stocks.

With a margin account you can qualify for Day Trading Buying Power DTBP. Day traders are not really what you would call long-term thinkers. Said another way investors can use margin to purchase potentially double the amount of marginable stocks than they could using cash.

Day trading using a cash account can easily lead to Good Faith Violations. You are only using the cash you have in your account. The number of day trades must comprise more than 6 of total trading activity for that same 5-day period.

For example if you are trading on a 50 to 1 margin then for every 1 in your account you are able to trade 50 in a trade. Day trading with a cash account means just that. The minimum equity requirement for a margin account is 2000.

Margin is the money borrowed from a broker to buy or short an asset and allows the trader to pay. However it is a risky one. How does margin work.

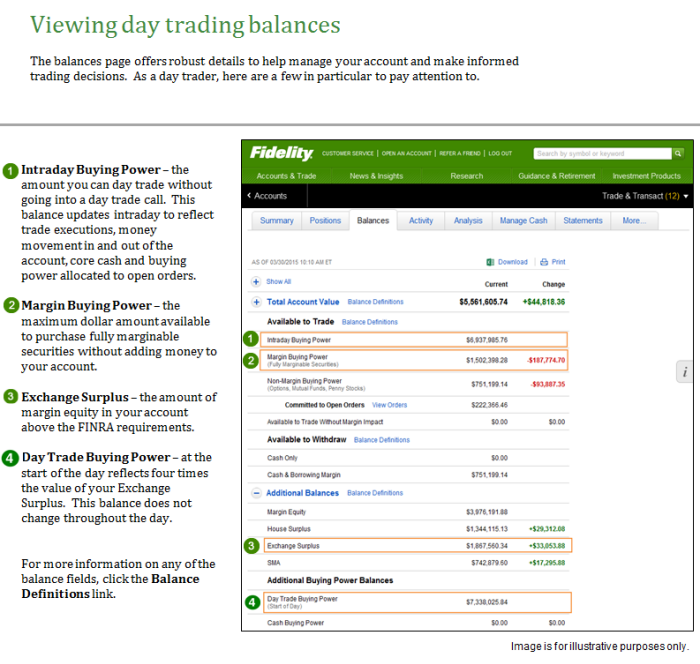

This refers to the amount of capital that is available to place trades on a specific day. In effect this gives you more buying power for stocksor other eligible securitiesthan your cash alone would provide. Please read more information regarding the risks of trading on margin.

Learn more about Cash Margin Account Day Trading Rules and Good Faith Violations. You borrow shares from a broker sell them on the market and then return an equal number of shares to the broker at some point in the future. Any margin customer who incurs two unmet day trade calls within a 90-day period.

Every day theyre glued to their computer screens and televisions in order to stay up to date on the news and any trends that might give them hints about which direction a companys stock will move that day. Get more details on trading and buying on margin and see how it works. Generally speaking brokerage customers who sign a margin agreement can borrow up to 50 of the purchase price of marginable investments the exact amount varies depending on the investment.

For each trade made in a margin account we use all available cash and sweep funds first and then charge the customer the current margin interest rate on the balance of the funds required to fill the order. While margin trading involves using borrowed money to buy securities such as stocks short selling involves selling borrowed stocks or commodities raw materials or crops such as silver or corn. Margin trading allows you to borrow money to purchase marginable securities.

Trading on margin is a common strategy employed in the financial world. Typically the way it works is your brokerage lends money to you at relatively low rates. Margin trading allows you to buy stock with money youve borrowed from your brokerage firm which allows you to purchase more.

Any margin customer who executes 4 or more day trades in a 5-business-day period. Day trading on margin refers to the practice of buying and selling the same stocks multiple times within the same trading day such that all positions are usually closed that trading day. In the Forex world brokers allow trading of foreign currencies to be done on margin.

Margin Trading Borrow up to 50 of your eligible equity to buy additional securities. How margin trading works. With a margin account you have the option to use leverage or margin to increase your buying power by borrowing funds from your broker.

The rules adopt the term pattern day trader which includes any margin customer that day trades buys then sells or sells short then buys the same security on the same day four or more times in five business days provided the number of day trades are more than six percent of the customers total trading activity for that same five-day period. Heres how short selling works. Day Trading with Cash vs.

The shortfall is filled by a brokerage firm at interest. This has both its drawbacks and advantages. Your Day Trading Buying Power is equal to the excess maintenance margin that is available in your account multiplied by four.

How I Improved My Bitcoin Exchange In One Day Dollar Bitcoinecuador Moneytrain Moneytrees Cryptocurrency Trading Trading Courses Community Signs

How I Improved My Bitcoin Exchange In One Day Dollar Bitcoinecuador Moneytrain Moneytrees Cryptocurrency Trading Trading Courses Community Signs

Margin In Forex Trading Forex Trading Forex Trade Finance

Margin In Forex Trading Forex Trading Forex Trade Finance

What Is Margin Trading Babypips Com Trading Understanding Learning

What Is Margin Trading Babypips Com Trading Understanding Learning

:max_bytes(150000):strip_icc()/DayTradingChartsandPatterns22-1713356e5c8c447691593574eebd9e60.png) 10 Day Trading Strategies For Beginners

10 Day Trading Strategies For Beginners

Learnforextrading Trading Charts Forex Trading Learn Forex Trading

Learnforextrading Trading Charts Forex Trading Learn Forex Trading

Day Trading Versus Swing Trading Which Is Better

Day Trading Versus Swing Trading Which Is Better

:max_bytes(150000):strip_icc()/day-trading-versus-swing-trading-58d2b0783df78c5162052d77.jpg) A Guide To Day Trading On Margin

A Guide To Day Trading On Margin

4h Breakout Forex System Learn Forex Trading Day Trading Trading Forex

4h Breakout Forex System Learn Forex Trading Day Trading Trading Forex

Margin Trading Gives Chances Of Earning A Higher Profit Compared To Traditional Trading But Also Entails Gre Stock Options Trading Trade Finance Trading Charts

Margin Trading Gives Chances Of Earning A Higher Profit Compared To Traditional Trading But Also Entails Gre Stock Options Trading Trade Finance Trading Charts

Learn How To Read Level 2 Trading Terminology Amp Definitions Youtube Stock Options Trading Day Trading Day Trader

Learn How To Read Level 2 Trading Terminology Amp Definitions Youtube Stock Options Trading Day Trading Day Trader

Day Trading Salary See How Much Top Traders Make A Year Day Trading Trading Fund Management

Day Trading Salary See How Much Top Traders Make A Year Day Trading Trading Fund Management

Margin Rate Definition Day Trading Terminology Warrior Trading

Margin Rate Definition Day Trading Terminology Warrior Trading

Futures Day Trading Margins Intraday Margin Ninjatrader Blog

Futures Day Trading Margins Intraday Margin Ninjatrader Blog

This Pin Was Discovered By Be Unique365 Discover And Save Your Own Pins On P Stock Trading Strategies Trading Charts Forex Trading Training

This Pin Was Discovered By Be Unique365 Discover And Save Your Own Pins On P Stock Trading Strategies Trading Charts Forex Trading Training

:max_bytes(150000):strip_icc()/GettyImages-1170687091-dfd9e5ca93404334b436bf1c3dfdc1d6.jpg) A Guide To Day Trading On Margin

A Guide To Day Trading On Margin

:max_bytes(150000):strip_icc()/chart-1905224_1920-a337342257d040e98bb4040792c5a7dd.jpg)

Post a Comment for "How Does Day Trading Margin Work"