Td Ameritrade Margin Account Day Trading

In the management of margin accounts. TD Ameritrade margin interest rates vary due to the base rate and the size of the debit balance on customer margin trading account.

How To Trade Pre Market Td Ameritrade Tutorial Youtube

How To Trade Pre Market Td Ameritrade Tutorial Youtube

The base rate is currently 775 with a maximum margin rate of 9.

Td ameritrade margin account day trading. TD Ameritrade Margin Interest Rates. In many cases securities in your account can act as collateral for the margin loan. For anyone that is flagged as a pattern day trader TD Ameritrade requires that you maintain a minimum day trading equity balance of 25000 which includes marginable and non-marginable securities on any day in which day trading occurs.

Day trade equity consists of marginable non-marginable positions and cash. This policy covers pretty much every conceivable fee one could come up with. When setting base rates TD Ameritrade considers indicators like commercially recognized interest rates industry conditions related to credit the availability of liquidity in the marketplace and general market conditions.

As of March 20 2020 the current base rate is 825. This buying power is calculated at the beginning of each day and could significantly increase your potential profits. Day trading power is equal to the equity in your account at the close of the previous business day minus the Self-Regulatory Organization SRO requirements and multiplied by up to four.

Make sure the Actively trade stocks ETFs options futures or forex button is selected. In addition TD Ameritrades margin costs are among the most expensive in the industry. You will also have to hold a 2000 minimum account balance for a margin account.

You could inform your broker saying yes Im a day trader or day trade more than three times in five days and get flagged as a pattern day trader. Margin trading privileges subject to TD Ameritrade review and approval. Margin interest rates vary among brokerages.

A pattern day traders account must maintain a day trading minimum equity of 25000 on any day on which day trading occurs. The requirements for portfolio margin are. Portfolio margin is only available to margin non-IRA accounts.

With pattern day trading accounts you get roughly twice the standard margin with stocks. Get real-time analysis and unparalleled strategy education into the days market events from industry pros from the TD Ameritrade Network. The 25000 account-value minimum is a start-of-day value calculated using the previous trading days closing prices on positions held overnight.

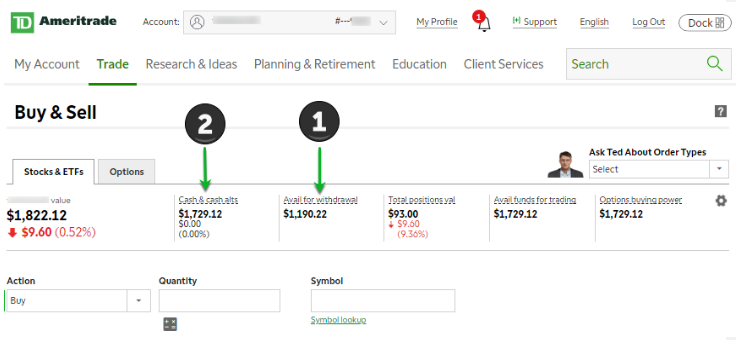

A Day Trading account with TD Ameritrade will enable you to day trade up to four times the amount of the equity in your account less the SRO Self-Regulatory Organization requirements which are generally equal to 25 of the value of your long positions. Fund your account with at least 2000 in cash or marginable securities. A TD Ameritrade account thats approved for margin trading must have at least 2000 in cash equity or eligible securities and a minimum of 30 of its total value as equity at all times.

Responsibilities of Trading on Margin The following is a list of some but not all of the responsibilities of account owners and TD Ameritrade Inc. Traders interested in margin accounts which have a 2000 minimum will be disappointed in TD Ameritrades margin rates which like their commissions are higher than average. Day trade equity consists of marginable non-marginable positions and cash.

However it is worth highlighting that this will also magnify losses. Annual low-balance maintenance opening closing and inactivity. Margin account owners responsibilities.

Are separate but affiliated subsidiaries of TD Ameritrade. To deposit into your margin account the necessary funds in cash. If you do want to officially day trade and apply for a margin account your buying power could be up to four times your actual account balance.

TD Ameritrade Media Productions Company and TD Ameritrade Inc. TD Ameritrade Network is brought to you by TD Ameritrade Media Productions Company. When setting base rates TD Ameritrade considers indicators like commercially recognized interest rates industry conditions related to credit the availability of liquidity in the marketplace and general market conditions.

Where TD Ameritrade Thinkorswim Misses the Mark Margin rates. Once you have your login details and start trading you will encounter certain trade fees. Open a TD Ameritrade account.

Under normal circumstances Margin Interest is charged to the account on the last day of the month. Margin interest rates vary due to the base rate and the size of the debit balance. Margin is not available in all account types.

Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. Keep a minimum of 30 of your total account value as equity at all times. The base margin rate is 775 while the maximum rate is 9.

A minimum of 125000 account equity you cannot combine accounts to reach this full options trading approval and three years of experience trading options. Since day traders hold no positions at the end of each day they have no collateral in their margin account to cover risk and satisfy a margin call a demand from a broker to increase the amount of equity in their accountduring a given trading day. The Cost of Day Trading at TD Ameritrade A brokerage account at TD Ameritrade has zero fees.

Getting started with margin trading. Drawbacks of a Margin Account The primary disadvantage of a margin account is that theyre subject to the pattern day trader PDT rule which states that those with less than 25000 of cash in their account cant make more than three day trades within a rolling five day period. For example TD Ameritrade doesnt allow you to short sell until you have 2000 in your trading account.

The 25000 account-value minimum is a start-of-day value calculated using the previous trading days closing prices on positions held overnight. Stock and ETF transactions are 0 each while option trades are 65 per contract. Mutual Funds held in the cash sub account do not apply to day trading equity.

A pattern day traders account must maintain a day trading minimum equity of 25000 on any day on which day trading occurs.

Td Ameritrade Short Selling Stocks How To Sell Short Fees 2021

Td Ameritrade Short Selling Stocks How To Sell Short Fees 2021

Shorting A Stock Seeking The Upside Of Downside Markets Ticker Tape

Shorting A Stock Seeking The Upside Of Downside Markets Ticker Tape

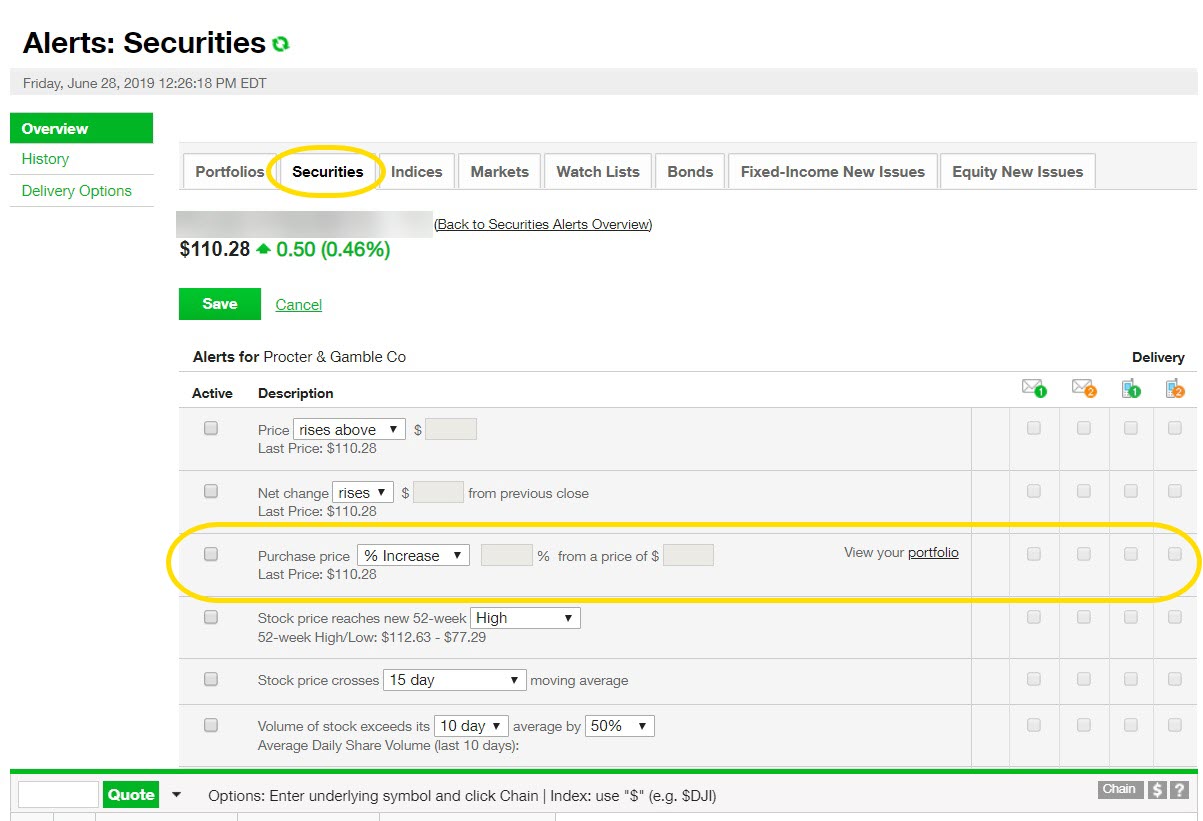

How To Use Alerts To Stay In The Know Ticker Tape

How To Use Alerts To Stay In The Know Ticker Tape

Luck Of The Draw There S A Lot More To Trading And I Ticker Tape

Luck Of The Draw There S A Lot More To Trading And I Ticker Tape

3 Must Enable Settings For Day Trading With Td Ameritrade Youtube

3 Must Enable Settings For Day Trading With Td Ameritrade Youtube

Td Ameritrade Pattern Day Trading Rules Pdt For 2021

Td Ameritrade Pattern Day Trading Rules Pdt For 2021

How To Fix Thinkorswim S Delayed Data And Get Real Time Data For Free Credit Card Help Real Time Data

How To Fix Thinkorswim S Delayed Data And Get Real Time Data For Free Credit Card Help Real Time Data

Td Ameritrade Margin Rates 2021

Td Ameritrade Margin Rates 2021

Advanced Stock Order Types To Fine Tune Your Market T Ticker Tape

Advanced Stock Order Types To Fine Tune Your Market T Ticker Tape

Td Ameritrade After Hours Pre Market Trading Extended Hours

Td Ameritrade After Hours Pre Market Trading Extended Hours

How To Close Td Ameritrade Account Closing Fee 2021

How To Close Td Ameritrade Account Closing Fee 2021

Using Margin Buying Power To Diversify Your Market Ex Ticker Tape

Using Margin Buying Power To Diversify Your Market Ex Ticker Tape

Managing The Strike Count How To Avoid Good Faith Vi Ticker Tape

Managing The Strike Count How To Avoid Good Faith Vi Ticker Tape

How To Buy Stock W Td Ameritrade 2 Min Youtube

How To Buy Stock W Td Ameritrade 2 Min Youtube

:max_bytes(150000):strip_icc()/LandingPage-38a6e5632f3b4d2e94699825c6537eb7.png)

Post a Comment for "Td Ameritrade Margin Account Day Trading"