Do You Get Penalized For Day Trading

25 100 20 of closing stock price 6000 premium 250 Out of the money amount 200 31250. If you held the stock for less than one year thats a short-term gain so you would pay income tax on that 1000 at the same rate as all of your other regular income such as your salary at work.

Etrade Pattern Day Trading Rules Pdt For 2021

Etrade Pattern Day Trading Rules Pdt For 2021

The consequences for violating PDT vary but can be inconvenient for investors who are not actively trading.

Do you get penalized for day trading. IRS tax laws exempt day traders from wash sale restrictions and capital loss limits. While day trading is neither illegal nor is it unethical it can be highly risky. Some brokers can reset your account but again this is an option you cant use all the time.

If you think youll get rich in a few weeks youre setting yourself up for disappointment. Trade 2 12 pm. You should contact your brokerage firm to obtain more information on whether it imposes more stringent margin requirements.

Established the pattern day trader rule which states that if you make four or more day trades opening and closing a stock position within the same day in a five-day period and those day-trading activities are more than 6 of your total trading activity in that five-day period youre considered a day trader and must maintain a minimum account balance of 25000. It is important to note that your firm may impose a higher minimum equity requirement andor may restrict your trading to less than four times the day traders maintenance margin excess. You can violate the pattern day trader PDT rules without realizing it.

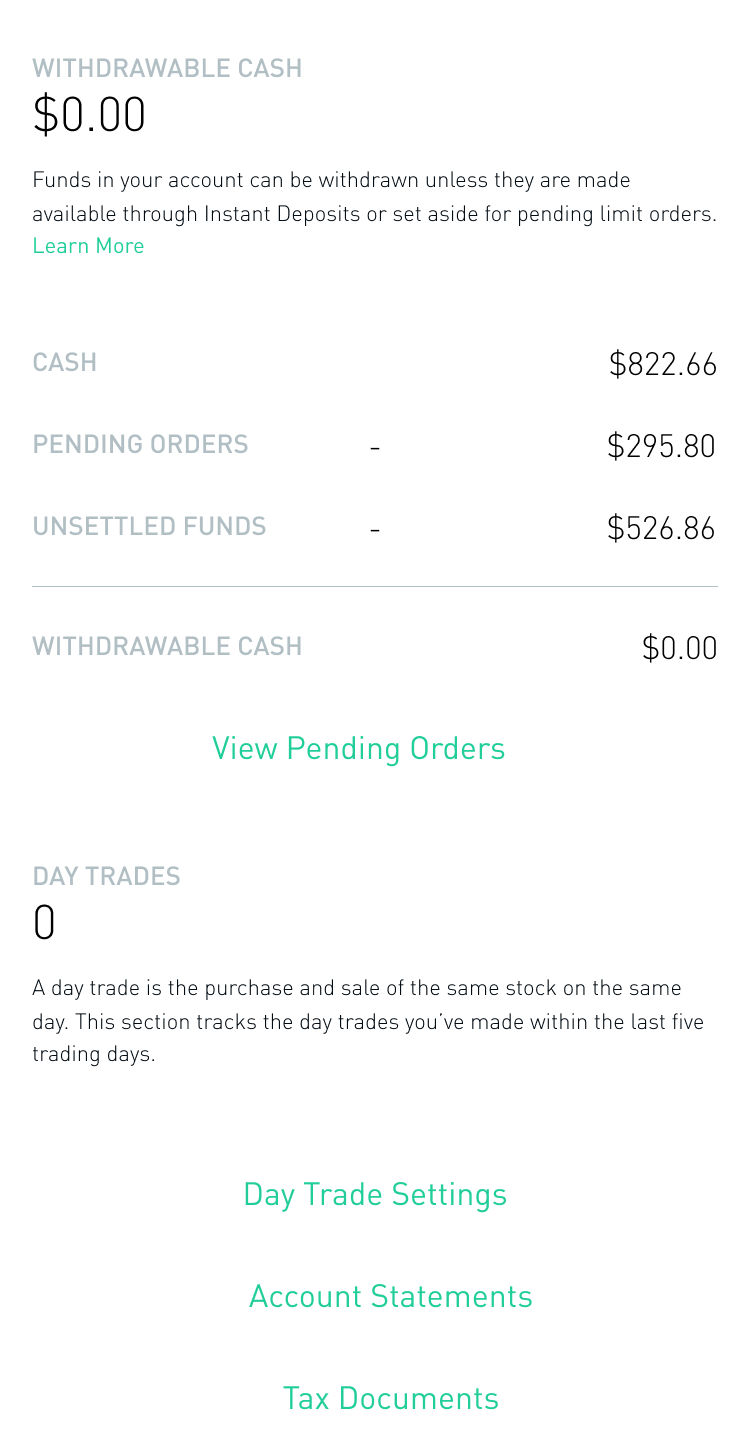

Each trade settles in 2 business days so youll be late paying for stock X which you bought on Monday. What happens when your account falls below 25000. If your goal is to earn small profits from numerous daily trades you might want to have the IRS designate you as a day trader.

Establishing realistic expectations is important. BTC 25 XYZ Dec 60 calls. FINRA rules define a pattern day trader as any customer who executes four or more day trades within five business days provided that the number of day trades represents more than six percent of the customers total trades in the margin account for that same five business day period.

According to industry standards most securities have a settlement date that occurs on trade date plus 2 business days T2. The Financial Industry Regulatory Authority FINRA in the US. Whether you are interested in long stocks spreads or even naked options there are several requirements that are important for you to be aware of before you get started.

Unless you bring your account balance to 25000 you will not be able to trade for 90 days. Whilst you do not have to follow these risk management rules to the letter they have proved invaluable for many. Here are some of the facts that every investor should know about day trading.

The customer has now day traded the naked options. During this time you must have settled funds available before you can buy anything. That means that if you buy a stock on a Monday settlement date would be Wednesday.

The moment your trading account is flagged as a pattern day trader your ability to trade is restricted. This includes some options contracts for example that require borrowing on margin. When you start out day trading or swing trading or if you want to get into it you may wonder how long it takes to become a successful trader.

In return the IRS expects day traders to keep scrupulous records of their trading activity and file accurate timely income tax returns. In this case the trader will need to maintain that balance if they wish to make any day trades. The idea is to prevent you ever trading more than you can afford.

So we covered some great ways to start day trading with less than 25k and some tips for trading smaller accounts. Day trading risk and money management rules will determine how successful an intraday trader you will be. Its best to check with your broker on day trading restrictions.

A broker may define pattern day trading as making two or three day trades in a five-day period and the brokerage may impose the 25000 minimum equity balance on these kinds of traders. In trying to get beyond the PDT you might put yourself out of the game completely. You also cant short stocks in Roth IRAs.

Knowing these requirements will help you make the right day trading decisions for your strategy. Day trading can be risky if not approached in the right manner so take your time learn the basics and start small. The charge against overnight buying power for entering into this trade is 31250.

A pattern day trader PDT is a regulatory designation for those traders or investors that execute four or more day trades over the span of five business days using a margin account. Most individual investors do not have the wealth the time or the temperament to make money and to sustain the devastating losses that day trading can bring. Certain trading strategies and contracts require margin accounts.

Any 3 violations in a rolling 52-week period trigger a 90-day funds-on-hand restriction.

Td Ameritrade Pattern Day Trading Rules Pdt For 2021

Td Ameritrade Pattern Day Trading Rules Pdt For 2021

Pattern Day Trading Rule Understanding Pdt Restrictions And Brokers With No Pdt Rule

Pattern Day Trading Rule Understanding Pdt Restrictions And Brokers With No Pdt Rule

Day Trading On Robinhood How It Works Restrictions

Day Trading On Robinhood How It Works Restrictions

:max_bytes(150000):strip_icc()/GettyImages-891634254_2400-acea07b464d94bedbd2d7b38f7c55e27.png) Day Trading Vs Swing Trading What S The Difference

Day Trading Vs Swing Trading What S The Difference

Is Day Trading A Good Idea Summit Wealth Group

Is Pattern Day Trading Illegal The Lie Of Pdt Being Bad

Is Pattern Day Trading Illegal The Lie Of Pdt Being Bad

Pattern Day Trader Rule Definition And Explanation

Pattern Day Trader Rule Definition And Explanation

Day Trading Taxes Explained Youtube

Day Trading Taxes Explained Youtube

Day Trading With Robinhood Is It A Good Idea Warrior Trading

Day Trading With Robinhood Is It A Good Idea Warrior Trading

Is Day Trading Crypto Worth It

Is Day Trading Crypto Worth It

How To Start Day Trading With 500 Warrior Trading

How To Start Day Trading With 500 Warrior Trading

How To Day Trade Without 25k Warrior Trading

How To Day Trade Without 25k Warrior Trading

Day Trading And Courses An Introduction To Trading Stock Trading Cryptocurrency Trading Stock Market

Day Trading And Courses An Introduction To Trading Stock Trading Cryptocurrency Trading Stock Market

Don T Get Caught Out By The Pattern Day Trader Pdt Rule By Leah Mathieson Medium

Don T Get Caught Out By The Pattern Day Trader Pdt Rule By Leah Mathieson Medium

Pattern Day Trader Workaround 10 Actionable Tips And Tricks

Pattern Day Trader Workaround 10 Actionable Tips And Tricks

Indices Trading Technical Trading Day Trader Technical Analysis

Indices Trading Technical Trading Day Trader Technical Analysis

:max_bytes(150000):strip_icc()/chart-1905224_1920-a337342257d040e98bb4040792c5a7dd.jpg)

Post a Comment for "Do You Get Penalized For Day Trading"