Day Trading Minimum Equity Call

Robinhood brokerage day trading rules active trader platform margin account requirements buying power limits calls fees and 25000 minimum equity balance SECFINRA restrictions. A Pattern Day Trader designation requires a minimum Margin equity plus cash in the amount.

Don T Get Caught Out By The Pattern Day Trader Pdt Rule By Leah Mathieson Medium

Don T Get Caught Out By The Pattern Day Trader Pdt Rule By Leah Mathieson Medium

Day Trading Buying Power for equity securities will be four 4 times the NYSE excess as of the close of business on the previous day and the time and tick method of calculating Day Trading is acceptable.

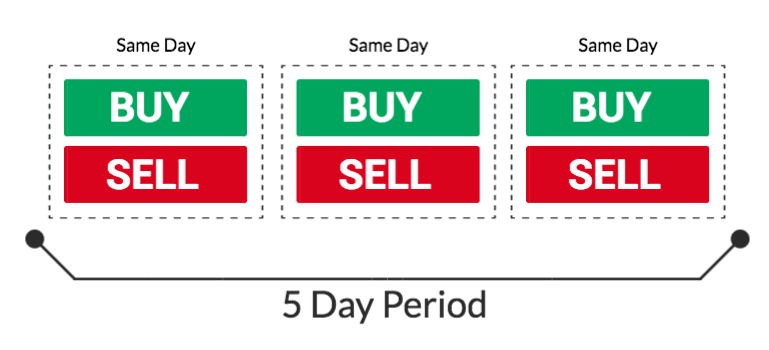

Day trading minimum equity call. Day trading is defined as buying and selling the same securityor executing a short sale and then buying the same security during the same business day in a margin account. Margin call to meet minimum equity. The Call does not have to be met with funding but while in the Call the account should not make any Day Trades.

An account that is both A Flagged as a Pattern Day Trader and B has less than 25000 equity will be issued a Day Trade Minimum Equity Call EM Call. TD Ameritrades day trading minimum equity call TD Ameritrade requires clients to hold equity of at least 25000 in an account at the start of any day when day trading happens. In order to day trade.

If your account is flagged as a pattern day trading account and your equity balance falls below the minimum required 25000 TD Ameritrade will issue a day-trading minimum equity call to your account. So tread carefullyIf you make four day trades in a rolling five days some brokerages may subject you to a minimum equity call meaning you have to deposit enough funds to have a minimum account. A pattern day trader account begins the day with margin equity of 1500 and starting DTBP of 1500.

Pattern day traders as defined by FINRA Financial Industry Regulatory Authority rules must adhere to specific guidelines for minimum equity and meeting day trade margin calls. Day Trading on Robinhood If youve been paying commissions on every single one of your day or swing trades maybe its time to consider a 0 broker. The minimum equity requirement for a customer who i as a pattern day trader is 25000.

This minimum equity must be deposited in the margin account before the customer may open trades and must be maintained in the customers account at all times. Trade 1 9 amBuy 50 ZZZ 55 2750. Day trading minimum equity.

This minimum must be restored by means of cash deposit or other marginable equities. A Guide to Day Trading on Margin. Is the minimum amount of.

The account has a prior open not yet past due DT call. The account must maintain at least USD 25000 worth of equity. The minimum equity requirement for a pattern day trader is 25000 or 25 of the total market value of securities whichever is higher while that for a non-pattern day trader is 2000.

Background on Day Trading Equity Requirement Back in 1974 before electronic trading the minimum equity requirement was only 2000. If an account has an outstanding Day Trading Margin Call Day Trading Buying Power will be reduced to two 2 times the NYSE excess and. A day trading minimum equity call is issued when the pattern day trader account falls below 25000.

A margin call is when money must be added to a margin account after a trading loss in order to meet minimum capital requirements. If you place a day trade in your account before restoring the minimum required equity your account will be restricted to cash trades only for the next 90 days or until the equity balance is brought back up to 25000. The required 25000 must be deposited in the account prior to any day-trading activities and must be maintained at all times.

This 25000 requirement must be deposited into th s designated e customers account prior to any day trading activities and must be maintained at all times. As a result the 2000 minimum equity requirement was not created to apply to day-trading activities Rather the 2000 minimum equity requirement was developed for the buy-and-hold investor who retained securities collateral in hisher account where the securities collateral was and still is subject to a 25 percent regulatory maintenance margin requirement for long equity securities. Day-Trading Minimum Equity Requirements May 14 2020 The minimum equity requirements on any day in which you trade is 25000.

In regards to margin requirements the minimum equity required for the accounts of customers deemed to be pattern day traders is 25000. New technology changed the trading environment and the speed of electronic trading allowed traders to get in and out of trades within the same day.

Zero Commission Day Trading Platform For Traders

Zero Commission Day Trading Platform For Traders

:strip_icc()/day-trading-tips-for-beginners-on-getting-started-4047240_FINAL-e9aa119145324592addceb3298e8007c.png) Day Trading Tips For Beginners

Day Trading Tips For Beginners

Td Ameritrade Pattern Day Trading Rules Pdt For 2021

Td Ameritrade Pattern Day Trading Rules Pdt For 2021

How To Day Trade Without 25k Warrior Trading

How To Day Trade Without 25k Warrior Trading

Day Trading Guide For Beginners 2021 Warrior Trading

Day Trading Guide For Beginners 2021 Warrior Trading

:max_bytes(150000):strip_icc()/day-trading-versus-swing-trading-58d2b0783df78c5162052d77.jpg) A Guide To Day Trading On Margin

A Guide To Day Trading On Margin

Yourguidetoforex Com Forex Brokers Forex Trading Forex Trading Tips

Yourguidetoforex Com Forex Brokers Forex Trading Forex Trading Tips

What Is A Margin Call Margin Call Formula Example

What Is A Margin Call Margin Call Formula Example

Pattern Day Trader Rule Definition And Explanation

Pattern Day Trader Rule Definition And Explanation

Pattern Day Trader Rule Definition And Explanation

Pattern Day Trader Rule Definition And Explanation

Etrade Pattern Day Trading Rules Pdt For 2021

Etrade Pattern Day Trading Rules Pdt For 2021

Weekly Lesson How To Navigate The Pattern Day Trader Rule

Weekly Lesson How To Navigate The Pattern Day Trader Rule

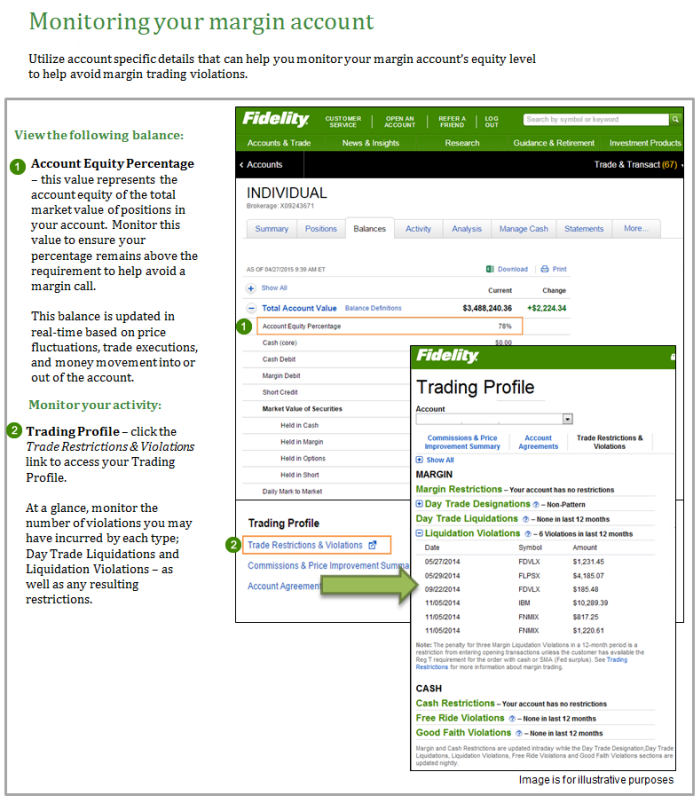

Margin Account Trading Violations Fidelity

Margin Account Trading Violations Fidelity

Day Trading With Less Than 25k Loopholes And Alternatives

Day Trading With Less Than 25k Loopholes And Alternatives

Highstrike Trading On Instagram If You Re Getting Into Options Trading It S Important To Visua Stock Trading Strategies Stock Options Trading Trading Quotes

Highstrike Trading On Instagram If You Re Getting Into Options Trading It S Important To Visua Stock Trading Strategies Stock Options Trading Trading Quotes

Shorting A Stock Seeking The Upside Of Downside Markets Ticker Tape

Shorting A Stock Seeking The Upside Of Downside Markets Ticker Tape

:max_bytes(150000):strip_icc()/chart-1905224_1920-a337342257d040e98bb4040792c5a7dd.jpg)

Post a Comment for "Day Trading Minimum Equity Call"